Getting The Ach Payment Solution To Work

Not to mention you can conserve yourself a couple of bucks by not needing to spend cash on stamps. In enhancement, an ACH settlement can be much more secure than other kinds of payment. Sending and obtaining ACH payments is normally fast. The negotiation of a purchase, or the transfer of funds from one financial institution to another by means of the ACH Network, usually happens the next day after it is initiated.

ACH transfers are typically quick, often totally free, and can be extra straightforward than writing a check or paying an expense with a credit history or debit card. Another advantage is that ACH transfers are usually free, depending upon where you bank as well as the kind of transfer involved. Your bank might bill you absolutely nothing to relocate money from your monitoring account to an account at a different financial institution.

The Single Strategy To Use For Ach Payment Solution

Cable transfers are recognized for their rate and are often made use of for same-day solution, but they can in some cases take longer to finish., for circumstances, it might take a number of service days for the money to relocate from one account to one more, then an additional few days for the transfer to clear.

There are some potential disadvantages to bear in mind when using them to move cash from one bank to an additional, send settlements, or pay expenses. Numerous financial institutions enforce limits on just how much cash you can send out through an ACH transfer. There might be per-transaction limits, everyday restrictions, and regular monthly or once a week limitations.

Or one kind of ACH transaction may be unrestricted but an additional might not. Banks can additionally impose limitations on transfer locations. For instance, they may restrict global transfers. Interest-bearing accounts are controlled by Federal Book Policy D, which may restrict certain kinds of withdrawals/transfers to six monthly. If you discuss that restriction with several ACH transfers have a peek at this website from cost savings to an additional bank, you might be hit with an excess withdrawal charge.

When you pick to send an ACH transfer, the time framework matters. That's due to the fact that not every financial institution sends them for financial institution processing at the very same time. There other might be a cutoff time by which you need to get your transfer in to have it refined for the following service day.

The Buzz on Ach Payment Solution

ACH takes approximately one to three organization days to complete and is considered slow-moving in the age of fintech as well as instant payments. Same-Day ACH handling is growing in order to fix the sluggish service of the typical ACH system. Same-Day ACH quantity increased by 73. 9% in 2021 from 2020, with a total amount of 603 million repayments made.

These services permit you to send out money online and also pay costs by establishing an account as well as connecting it up to your credit or debit card. Bear in mind, though, that these firms usually charge a cost. The largest advantage of these apps, in addition to being easy to utilize, is the speed they can provide for transfers.

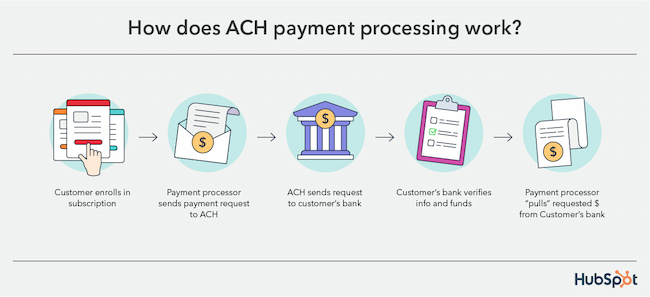

That provides a side over ACH transfers. An ACH bank transfer is a digital repayment made in between banks for repayment functions. The network that these settlements happen across is called an "automatic clearing house." ACH bank transfers are made use of for numerous functions, such as direct down payments of incomes, debts for routine payments, as well as cash transfers.

The Ultimate Guide To Ach Payment Solution

In either case, make certain you understand your financial institution's plans for ACH direct down payments and straight settlements. Be alert for ACH transfer rip-offs. A common scam, for example, includes somebody sending you an e-mail telling you that you're owed money, as well as all you require to do to obtain it is provide your bank account number and routing number.

Editor's note: This visit the site write-up was initial published April 29, 2020 as well as last updated January 13, 2022 ACH stands for Automated Clearing Home, a united state economic network made use of for electronic payments and money transfers. Additionally understood as "direct payments," ACH settlements are a way to transfer cash from one savings account to another without making use of paper checks, charge card networks, cable transfers, or cash. ach payment solution.

As a customer, it's most likely you're already familiar with ACH settlements, even though you might not be conscious of the jargon. If you pay your costs digitally (instead of creating a check or getting in a credit history card number) or obtain direct deposit from your employer, the ACH network is probably at job.